An Interview with Lani Darmawan, President Director at CIMB Niaga

Lani Darmawan, President Director at CIMB Niaga. | Photo: CIMB Niaga.

Can you tell us about your organization and your current role?

As part of CIMB Group in Malaysia, CIMB Niaga is the second largest private bank by total assets in Indonesia with a sustainable finance portfolio of 25.6% as per September 2023. We offer our customers the most comprehensive portfolio of conventional and sharia banking services in Indonesia, combining our strengths in consumer banking, SME, commercial and corporate banking, treasury, and payment services with the support of our 400 over branches nationwide along with our branchless banking platforms.

I was appointed as President Director of CIMB Niaga based on the EGM Resolution on 17 December 2021. Within sustainable finance governance, together with all directors, I am jointly responsible for establishing strategy and direction of sustainability in CIMB Niaga, as well as implementing sustainability principles within the Bank, which are directly supervised by the Board of Commissioners.

What are your corporate sustainability commitments and goals?

CIMB Niaga is committed to integrating and harmonizing environmental, social, and governance (ESG) aspects in its business activities, supporting the Sustainable Development Goals (SDGs) and advancing low carbon economy. In September 2022, CIMB Group, including CIMB Niaga, launched Sustainability Commitments as follows:

- Net zero GHG emissions for Scopes 1 and 2 in operations by 2030

- Net zero GHG emissions for Scopes 1, 2 and 3 by 2050

- No Deforestation, No Peat, No Exploitation (NDPE) commitment

- Mobilizing RM60 billion or equivalent to IDR 208 trillion towards Sustainable Finance by 2024

- Invest RM150 million over five years and 100,000 in employee volunteerism hours annually by 2024

To strengthen our commitments, CIMB Group, including CIMB Niaga issued decarbonization targets in several high-intensity emission sectors, including halving thermal coal mining sector exposure by 2030 from 2021 base year, reducing the cement sector’s emission intensity by 36% to 0.46 tCO2e/t cement by 2030 from 2021 base year, reducing palm oil sector emissions intensity by 16% by 2030 from 2022 base year, and reducing power sector emissions intensity by 38% by 2030 from 2022 base year.

We will work closely with existing and new customers to develop, enable, and accelerate their transition plans toward Net Zero.

What have been your most difficult challenges in achieving those goals?

In general, we identified several challenges that require support from key stakeholders. First, the lack of expertise and/or experts in assessing and analyzing green/social projects. Second, the relatively high risk of green financing, the mismatch risk of loan tenor vs bank’s funding sources, and relatively limited support from government/regulator towards the stakeholders. Lastly, we also find the risk of greenwashing challenging, as it will significantly affect one’s reputation as well as the encouragement to create value proportion for sustainable finance implementation.

What opportunities do you see to address those challenges?

We identified several opportunities. First, the growth of awareness and demand in the market. The International Finance Corporation (IFC) estimated the potential climate investment in Indonesia at more than USD 274 billion by 2030. There is also enthusiasm for carbon unit purchase in the market, indicated by more than 450k of carbon units traded in the first carbon trading session. Additionally, there is an increase in green/sustainable product awareness & demand. As of 2020, Indonesia has the second-largest sustainable finance market in ASEAN, with over USD 5 billion in issuances since 2018

Second, the various sustainable finance products and innovations. There has been an increase in market preference to use environmentally friendly products despite higher prices. There are many opportunities in collaboration between banks and their clients to achieve climate action targets, which is shown in the increased market demand for sustainable finance products, such as Sustainability-Linked Loan and Green Loan, amongst others.

Third, positive perception from investors towards institutions committed to implementing sustainable finance. Investors are driving institutions to have programs that are in line with the net zero emissions target. There is also a rising number of green investors. According to Bloomberg Intelligence, USD 35 trillion in global assets in 2020 were managed based on environmental, social, and governance considerations, an amount that is on course to reach USD 50 trillion by 2025.

What are the ESG material (environmental, social, and governance) issues that your organization focuses on, and how do you integrate them into your corporate sustainability?

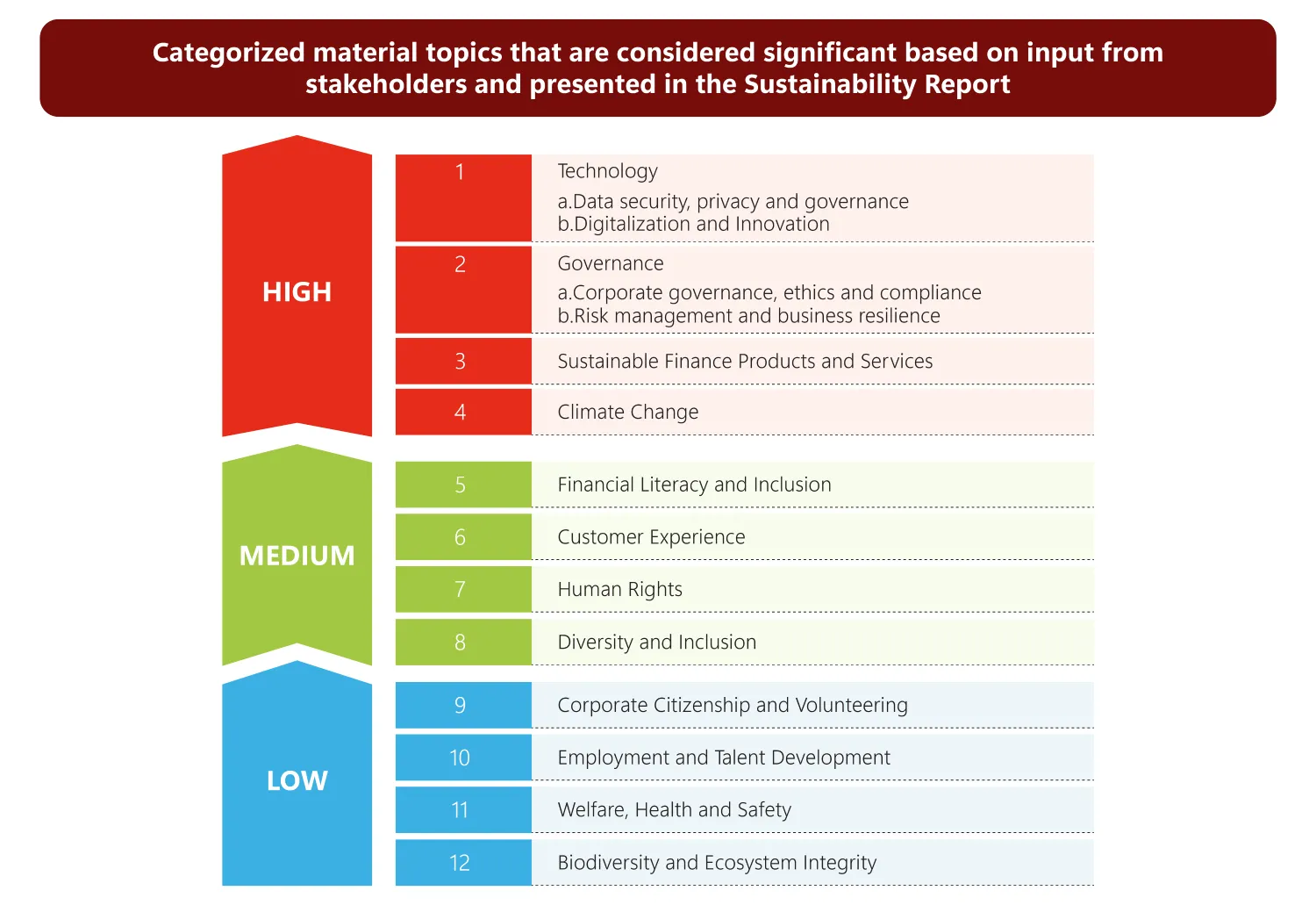

In 2022, CIMB Niaga conducted a materiality assessment to adjust issues and performance that are relevant to the Bank. It was carried out through the distribution of surveys to stakeholders such as employees, customers, and vendors of the Bank. Through investor and analyst meetings, CIMB Niaga also receives feedback from a variety of external stakeholders, such as investors and rating agencies.

We integrate these materiality topics below through adoption towards our strategy (Sustainable Finance Action Plan), our internal policy, as well as public reporting (Sustainability Report).

How do you communicate your corporate sustainability strategy and initiatives to internal and external stakeholders?

CIMB Niaga is actively engaging and participating in the local sustainable finance ecosystem to reach out to our internal and external stakeholders. We publish a Sustainability Report annually to share our progress in sustainability implementation with the public. This sustainability report refers to national regulations (POJK 51/2017 regarding Sustainable Finance) as well as international standards such as GRI, TCFD, SASB, WWF SUSBA, SDGs, GISD Alliance and is assured by an independent third party.

We have also annually held “The Cooler Earth Sustainability Summit” (“TCE”) since 2019, as a program initiated by the CIMB Group to bring together experts, stakeholders, and people from all over the world to discuss and exchange ideas regarding creating a better future. The 2023 event was joined by 3,756 online participants and 216 onsite participants.

CIMB Niaga also launched a talk show program series to engage with the public, such as via “Cerita untuk Masa Depan” (Stories for the Future), which presents inspirational speakers to discuss sustainability-relevant issues.

Since 2019, CIMB Niaga has become one of the members of the Indonesia Sustainable Finance Initiative (IKBI). By becoming a member of IKBI, we hope to contribute to the implementation and development of Sustainable Finance in Indonesia.

What were the most exciting initiatives and progress that you and your team have done in 2023?

CIMB Niaga is taking steps towards sustainable finance by leveraging initiatives, products, and services that adopt or support sustainable finance principles, namely:

- Provision of Sustainability-Linked Loan to finance our client who commits to improving their sustainability performance

- Became the initial buyer that purchases carbon units at IDX Carbon Launching on 26 September 2023

- Carrying out the Climate Risk Stress Test analysis pilot project

- Implementing Net Zero target-setting projects for four high emissions intensity sectors (Palm Oil, Power, Oil & Gas and Real Estate)

What are the lessons you learned from your sustainability efforts in 2023?

There is a growing enthusiasm and effort from key stakeholders to make the world “greener” and more sustainable. We observed more partnerships, deals, and initiatives in the market, especially to support the achievement of SDGs and Climate Action.

Greenwashing is a major concern in the sustainability arena. Therefore, we always need to refer to the relevant and reliable standards/norms to evaluate “the truth”.

What are your plans for your sustainability efforts in 2024?

CIMB Niaga will look forward to providing continuous support for the achievement of global goals (such as SDGs and Climate Action), in line with our clients’ framework on their continuous journey towards achieving their sustainability target.

In addition, CIMB Niaga is also implementing ways to introduce its new products and services based on ESG principles. We will continue to increase our sustainable finance portfolio, at least maintained at 25% of the bank’s total financing that always grows year-by-year. We also plan on launching various sustainable finance-relevant products and/ or programs to meet our customers’ needs. Additionally, we aim to develop and strengthen our internal operations that align with sustainability trends & development, such as the alignment of our internal policies and practices with Diversity, Equity, and Inclusion topics and the preparation of a Greenwashing policy.

CIMB Niaga also plans on initiating several projects to support climate action, such as:

- Carrying out the Climate Risk Stress Testing analysis

- Launch the 2030 net zero target for another 2 high-intensity emission sectors

- Implementing the strategy to achieve net zero targets launched in 2023

- Active participation in the carbon exchange market

- Implementing various energy efficiency initiatives to support our commitment on Net Zero GHG Scope 1 & 2 by 2030

Lastly, we embrace our key stakeholders to work together towards inclusive, equitable, and low-carbon national economic growth by organizing the annual The Cooler Earth Sustainability Summit and actively contributing to the sustainability ecosystem, national, and international forums, for example, through membership in the ESG Working Group PERBANAS, FKDKP, IKBI, etc.

If you were to share advice you learned in your role that may be helpful to your peers and sustainability practitioners around the world, what would that be?

Commitment is important, especially from the regulators and investors, to drive sustainability forward.

Sustainability is a “new world” for everyone. Thus, it is our journey together to learn and strengthen our sustainability performance – investing for a better future.

This publication is a part of Green Network Asia’s Leaders in Sustainability Special Report 2023.

Looking into the Global Midwife Shortage

Looking into the Global Midwife Shortage  Reframing Governance in the Era of Water Bankruptcy

Reframing Governance in the Era of Water Bankruptcy  Strengthening Resilience amid Growing Dependence on Space Infrastructure

Strengthening Resilience amid Growing Dependence on Space Infrastructure  Indian Gig Workers Push Back Against 10-Minute Delivery Service Strain

Indian Gig Workers Push Back Against 10-Minute Delivery Service Strain  Call for Governance: Grassroots Initiatives Look to Scale Efforts to Conserve Depleting Groundwater

Call for Governance: Grassroots Initiatives Look to Scale Efforts to Conserve Depleting Groundwater  Integrating Environment, Climate Change, and Sustainability Issues into Education Systems

Integrating Environment, Climate Change, and Sustainability Issues into Education Systems