Blended Finance & Mandalika: Civil Society Organizations’ Recommendations for Accountability and SDG Achievement

The cover of policy brief by INFID on Blended Finance Implementation in Mandalika Special Economic Zone development Project. | Photo: Green Network Asia.

Funding plays a significant role in achieving the Sustainable Development Goals. Unfortunately, financing gaps remain one of the biggest challenges to solve globally, regionally, and nationally. Blended Finance could bridge those financing gaps, including in Indonesia. One example is the Mandalika Special Economic Zone, which utilizes public-private financing to build a new tourism destination in West Nusa Tenggara. However, a recent policy brief reveals that the implementation of Blended Finance in the Mandalika project is not yet accountable.

Indonesia’s Vision & SDG Achievement

Indonesia’s commitment to implementing the Sustainable Development Goals (SDGs) is an indispensable part of the Vision of Indonesia 2045, which aims to position Indonesia as a sovereign, advanced, fair, and prosperous nation in its centennial journey of independence by 2045 through various sustainable and inclusive development processes within the framework of SDGs.

Despite all the progress and developments, Indonesia still has to deal with financing gaps as one of the main challenges in achieving the 2030 Agenda. Financing gaps also exist in various development projects supporting the acceleration of SDG achievements in the Decade of Action (2021-2030). Every SDG financing need scenario calculated by the Ministry of National Development Planning (Bappenas), including the high, moderate, and business-as-usual scenarios, reflects this gap.

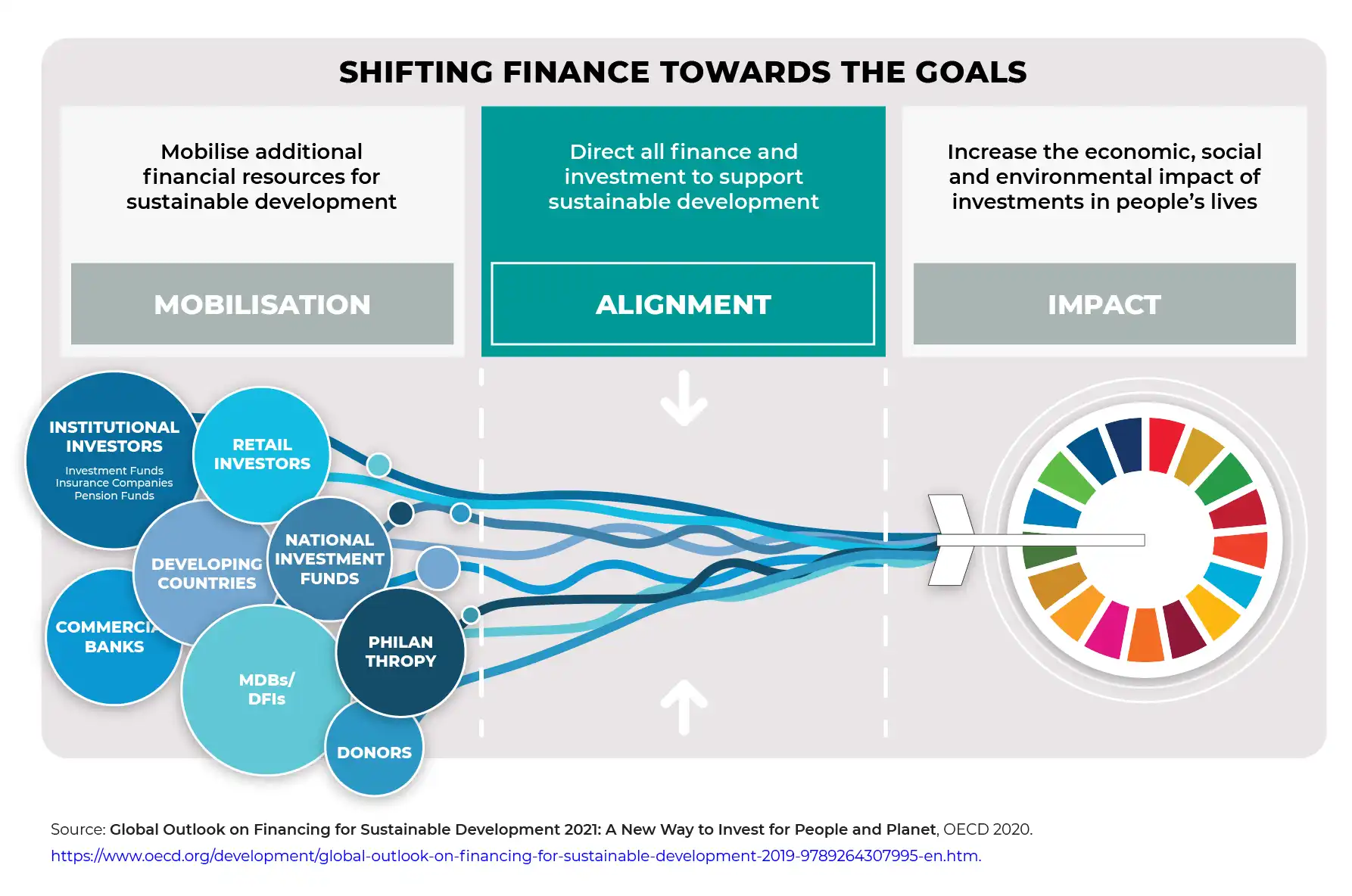

In this light, Blended Finance is seen as one of the solutions to bridge the SDG financing gap. This financing method has been considered mainstream in international development financing strategies and policies.

Blended Finance Accountability in Development Projects

The Organization for Economy Co-operation and Development (OECD) defines Blended Finance as the strategic use of development finance to mobilize additional finance from commercial finance resources to development projects, which aims to achieve SDGs in developing countries. “Development finance” refers to concessional and non-concessional sources, public and private philanthropy, which is managed by development mandate and does not ask for a return of investments; for example, State Budget (APBN), Local Government Budget (APBD), and grants. “Additional commercial financing” refers to the commercial capital sourced from both public and private, which is mobilized by the mandate to achieve commercial profits.

Civil Society Organizations (CSOs) urge increased accountability in implementing Blended Finance in development projects through comprehensive monitoring and evaluation and fundamental improvements from all stakeholders. It is crucial for all stakeholders to uphold SDG principles such as the “Human Rights-Based Approach” and “Leaving No One Behind,” Business and Human Rights principles, and Blended Finance principles in development projects to ensure high-quality standards and accountability. With these principles, development projects can run effectively and accelerate SDG achievements in Indonesia towards the Vision of Indonesia 2045.

Mandalika Special Economic Zone: A Case Study

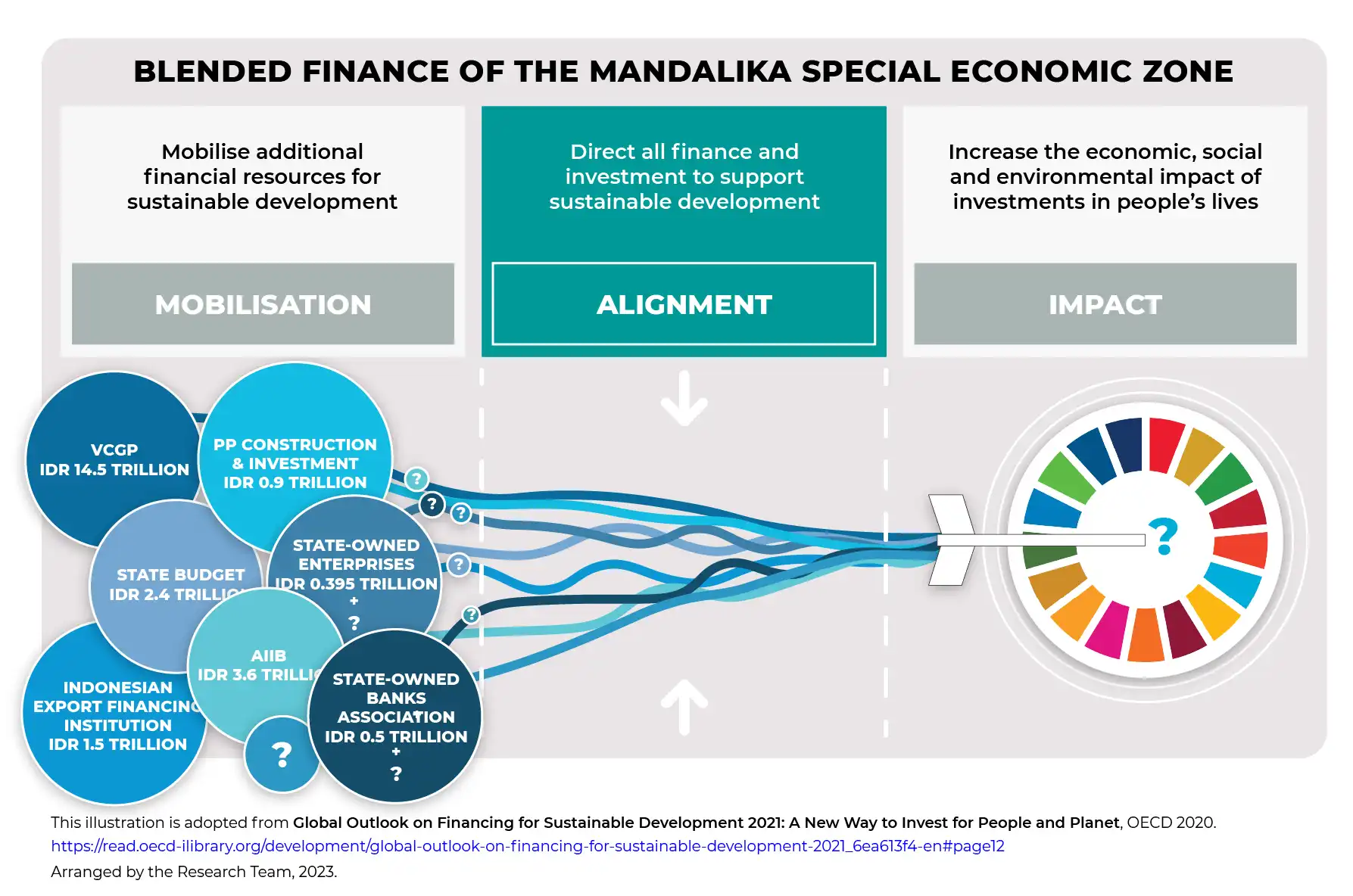

The Mandalika Special Economic Zone (SEZ), located in West Nusa Tenggara, is a development project using the Blended Finance scheme in Indonesia. Besides receiving public financing from the State Budget (APBN), the government and project manager (ITDC) utilize financing from Multilateral Development Bank AIIB through the Mandalika Urban and Tourism Infrastructure Project as a sovereign-backed loan to build the core infrastructure for Mandalika SEZ as a new tourism destination. This strategy becomes a leverage to mobilize additional commercial financing for Mandalika SEZ, including from State-Owned Banks Associations (Himpunan Bank Milik Negara/HIMBARA), PP Construction & Investment, Indonesian Export Financing Institution, and international private investor Vinci Construction Grands Projets (VCGP), the subsidiary of Vinci. Vinci is a global-scale French company specializing in the design, financing, development, and operations of big infrastructure and facilities projects across the globe.

According to OECD’s SDG-aligned finance framework, the accountability of Mandalika SEZ financing can be evaluated by assessing the financing sources based on equality and sustainability. Equality means resources should be mobilized to leave no one behind and fill the SDG financing gaps, whereas sustainability means resources should accelerate progress across the SDGs while doing no significant harm in any of the SDGs.

A policy brief published by the International NGO Forum on Indonesian Development (INFID) in partnership with Green Network Asia titled “Improving The Implementation Of Blended Finance In Development Projects to Achieve The 2030 Sustainable Development Goals Towards The Vision Of Indonesia 2045: A Case Study Of The Mandalika Special Economic Zone” reveals that the implementation of Blended Finance in the Mandalika SEZ project is not yet accountable. This conclusion is drawn based on the various social, economic, environmental, and law & governance issues that resulted in significant losses in various SDG achievements and left people affected by the project behind. The issues are:

- Social issues: impoverishment, food insecurity, mental welfare, school dropouts, and gender inequality.

- Economic issues: unaffordable energy resources, minimal training, loss of financial independence, ineffective partnership, and social, political, and economic inequality.

- Environmental issues: lack of water and sanitation, inability to practice culture, lack of sustainability report, loss of access to ocean & agriculture, and dredging hills.

- Law & governance issues: lack of transparency and accountability, including financial governance.

The finding and discussion in the policy brief are hoped to contribute to starting and mobilizing further proper and comprehensive Monitoring and Evaluation, as a tool for improvements in implementing Blended Finance in the Mandalika SEZ development project. This analysis method can be adapted to other tourism special economic zones and development projects in different contexts.

Policy Recommendations

The policy brief shares several policy recommendations for all stakeholders to improve the Blended Finance implementation in the Mandalika SEZ development project to be more accountable and able to accelerate SDG achievements towards the Vision of Indonesia 2045.

For National and Local Governments:

- To integrate the Monitoring and Evaluation of the Mandalika SEZ into the Monitoring and Evaluation of the SDG achievement in Central Lombok Regency, West Nusa Tenggara, and Indonesia national level.

- To create a designated dashboard for integrated Blended Finance accessible to every stakeholder and the public in real-time, including the list of ongoing Blended Finance projects and those open for investments.

For the Mandalika SEZ Project Operator:

- To create a standardized public company sustainability report that reveals the progress, challenges, and overall performance of the company related to the Mandalika SEZ development project. The report should be proven by releasing annual reports that the public can access.

- To increase company responsibility, transparency, and accountability through various measured mechanisms, including periodic financial reports accessible to the public as a form of public communication regarding financial management, commercial return, and development result.

For Donors, Philanthropy, Multilateral Development Banks, and Private Investors;

- To assess the government’s SDG report and the ITDC’s sustainability report as the policy foundation to distribute funding to the Mandalika SEZ.

- To clarify and confirm the sustainability claims in implementing development projects through due diligence, periodic Monitoring and Evaluation as input for adjustment by involving independent experts and practitioners, especially for the development project with high social and environmental risks such as the Mandalika SEZ.

- To distribute financing for investment according to the context and needs of local people, such as financial inclusion to empower women and MSMEs in the Mandalika SEZ. This is a prospective and relevant investment opportunity to support sustainable tourism according to the third principle of Blended Finance.

- Considering the complaint mechanism has been inactive, it is crucial to open rooms to file complaints that are simple, accessible, and can be used by the people impacted by the project according to their social and economic profiles.

For Civil Society Groups:

- To rapidly develop capacity and improve skills regarding the development of innovative financing, including Blended Finance, to understand the theory and practice of innovative funding on a global, national, and local scale.

- To arrange a mechanism to monitor development projects and assistance for communities affected by the project that is simple, accessible, and can be used by the people impacted by the project according to their social and economic profiles.

- To actively collaborate in partnerships to achieve SDGs with governments and private sectors by sharing knowledge, skills, and experiences independently, objectively, scientifically, and evidence-based.

Read the full policy brief in Indonesian here.

Translator: Kresentia Madina

Co-create positive impact for people and the planet.

Amidst today’s increasingly complex global challenges, equipping yourself, team, and communities with interdisciplinary and cross-sectoral insights on sustainability-related issues and sustainable development is no longer optional — it is a strategic necessity to stay ahead and stay relevant.

Marlis Afridah

Marlis is the Founder & CEO of Green Network Asia. She holds a master's degree in Public Policy from the Lee Kuan Yew School of Public Policy at the National University of Singapore. She is an interdisciplinary public policy researcher and public affairs practitioner with an integrated focus on sustainability and sustainable development. She brings over a decade of cross-sector professional experience supporting governments, businesses, and civil society across the Asia Pacific and beyond, mainly on policy research and advocacy, government relations, and stakeholder engagement.

Impacts of E-waste Pollution on Animals and Human Health

Impacts of E-waste Pollution on Animals and Human Health  Africa’s Solar Energy Surge: Why 2025 Was a Breakthrough Year

Africa’s Solar Energy Surge: Why 2025 Was a Breakthrough Year  Agrihoods: Integrating Farms and Urban Neighborhoods into Sustainable Communities

Agrihoods: Integrating Farms and Urban Neighborhoods into Sustainable Communities  Women in Waste Management: Asia’s Circularity Runs on Women. Its Policies Still Don’t

Women in Waste Management: Asia’s Circularity Runs on Women. Its Policies Still Don’t  Embracing the Business Value of Sustainability

Embracing the Business Value of Sustainability  American Farmers Call for Government Support Amidst PFAS Contamination

American Farmers Call for Government Support Amidst PFAS Contamination